Traveling with your family is a wonderful experience that creates lasting memories. However, unforeseen circumstances can sometimes disrupt your plans. That’s where comprehensive family travel insurance comes into play. This article will explore what it covers to help you make informed decisions and ensure your family’s safety and security during your adventures.

Table of Contents

Understanding the Basics

It is designed to protect your family against unexpected events before or during your trip. It covers various travel-related risks, allowing you to enjoy your vacation with peace of mind.

Why is it Important?

Traveling with family involves more than just yourself; you are responsible for the well-being of your loved ones as well. This insurance is essential because it helps safeguard your family’s financial investment in the trip and provides assistance when needed, such as during medical emergencies or trip disruptions.

Key Coverage Areas

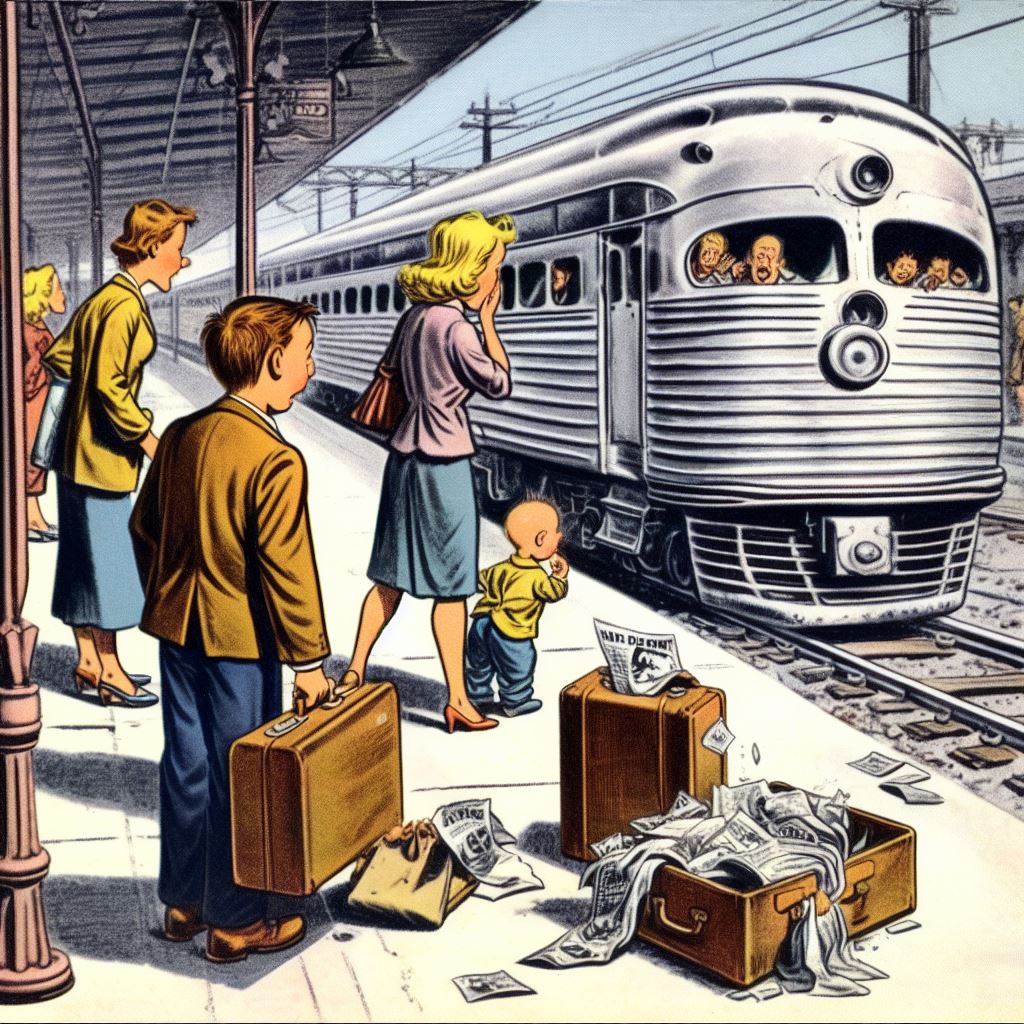

1. Trip Cancellation and Interruption

It typically includes coverage for trip cancellations and interruptions. This means you can receive reimbursement for non-refundable travel expenses if you need to cancel your trip before departure or if it gets cut short due to unforeseen events, such as a family member’s illness, natural disasters, or other covered reasons.

2. Emergency Medical Expenses

One of the most critical aspects of family travel insurance is coverage for emergency medical expenses. It ensures that your family members receive necessary medical care while abroad, including doctor visits, hospital stays, surgeries, medications, and even medical evacuation if required. Additionally, be aware of the policy’s network of hospitals and healthcare providers at your destination to ensure quick and hassle-free access to medical services when needed during your family trip.

3. Baggage and Personal Belongings

Losing luggage or having personal belongings stolen can be disruptive and distressing, especially when traveling with family. Comprehensive policies cover such incidents, reimbursing you for the value of your lost or stolen items. This helps you replace essential items and continue your trip without major disruptions.

4. Travel Delay and Missed Connections

Travel delays and missed flight connections are common travel hiccups. Family travel insurance often includes coverage for these situations, offering reimbursement for additional expenses incurred due to delayed or missed flights, such as accommodations and meals.

5. Rental Car Coverage

If you plan to rent a car during your trip, some family travel insurance policies may include coverage for rental car damages or theft. This can save you money on expensive rental car insurance agencies offer.

6. Travel Assistance Services

These insurance policies also typically provide access to travel assistance services. These services can be invaluable when encountering difficulties while traveling, offering support in locating medical facilities, rebooking flights, and even arranging home transportation if needed.

7. Emergency Evacuation

In the unfortunate event of a natural disaster, political unrest, or other emergencies at your destination, this insurance may cover the cost of emergency evacuation to ensure your family’s safety.

8. Coverage for Pre-Existing Medical Conditions

It’s essential to inquire whether the policy covers pre-existing medical conditions. Some policies may offer coverage for these conditions if certain conditions are met, while others may exclude them.

Finding the Right Insurance

Assessing Your Family’s Needs

Before purchasing the insurance, assess your family’s specific needs and the nature of your trip. Consider factors such as the destination, the duration of your stay, any pre-existing medical conditions, and the activities you plan to engage in. This assessment will help you determine the type and level of coverage required.

Comparing Policies

Once you’ve identified your family’s needs, it’s time to compare policies from different insurance providers. Pay close attention to coverage limits, deductibles, and exclusions. Look for flexible and customization policies to match your family’s requirements. When comparing policies, also consider the reputation and customer reviews of the insurance providers to ensure you’re choosing a reliable and customer-friendly company for your family’s travel insurance needs.

Reviewing Policy Terms and Conditions:

Take the time to read and understand the policy terms and conditions carefully. It’s crucial to know what is covered and what isn’t. Pay particular attention to any pre-existing medical condition exclusions and the process for filing claims.

Considering Additional Coverage:

Depending on your family’s travel plans, you may want to consider additional coverage options. For instance, if you’re planning adventurous activities like skiing or scuba diving, check if your policy includes specialized coverage for these activities.

Seeking Professional Advice

If you’re unsure which policy to choose or need assistance assessing your family’s coverage needs, consider consulting a travel insurance expert or a financial advisor. They can provide valuable insights and help you make an informed decision.

Final Thoughts on Family Travel Insurance

Comprehensive family travel insurance is a valuable investment that ensures your family’s safety, security, and peace of mind while exploring new destinations. It covers various unexpected events, allowing you to enjoy family vacations without unnecessary worries. So, before you embark on your next family adventure, take the time to explore your options, choose a policy that matches your family’s needs, and travel with confidence, knowing that you’re prepared for whatever comes your way.

Related Reading

Mail in the Cloud: Why Full-Time Travelers Should Have an Online PO Box

5 Live Coral Gables Webcams – Complete Coral Gables Florida News & Weather