US inflation data suggests more changes ahead. The US Federal Reserve has a two-tiered policy goal of maximum employment and price stability. It is tasked with balancing the need for job creation with the risk of inflation to keep prices stable. After years of low inflation, the Fed was hiking interest rates in 2018 in order to keep inflation in check.

What is Inflation

The main drivers of inflation are generally either excess demand in the economy or too much money chasing too few goods and services. Inflation can also be caused by an increase in production costs, such as when the cost of raw materials goes up.

In the United States, inflation has been relatively low in recent years, averaging around 2% per year. However, some economists are concerned that inflation may start to pick up in the coming months as the economy continues to strengthen. If inflation does start to rise, it could put pressure on the Federal Reserve to raise interest rates.

Causes of Inflation

Inflation in the United States is caused by various factors, but the most important factor is the Federal Reserve’s monetary policy. The Fed has two main tools to influence inflation: interest rates and quantitative easing.

When the Fed lowers interest rates, it makes borrowing money cheaper. This encourages businesses to invest and hire more workers, which increases economic activity and can lead to inflation. The Fed can print more money, which puts more money into circulation and can cause inflation.

The other main factor that contributes to inflation is the cost of energy and other commodities. When energy prices go up, it costs more to produce goods and services, which can lead to higher prices for consumers.

Inflation can also be caused by government spending. When the government spends more money than it takes in through taxes, it has to print more money to cover the deficit. This puts more money into circulation and can cause inflation.

Latest US Inflation Data Raises Questions About Upcoming Interest Rate Hikes

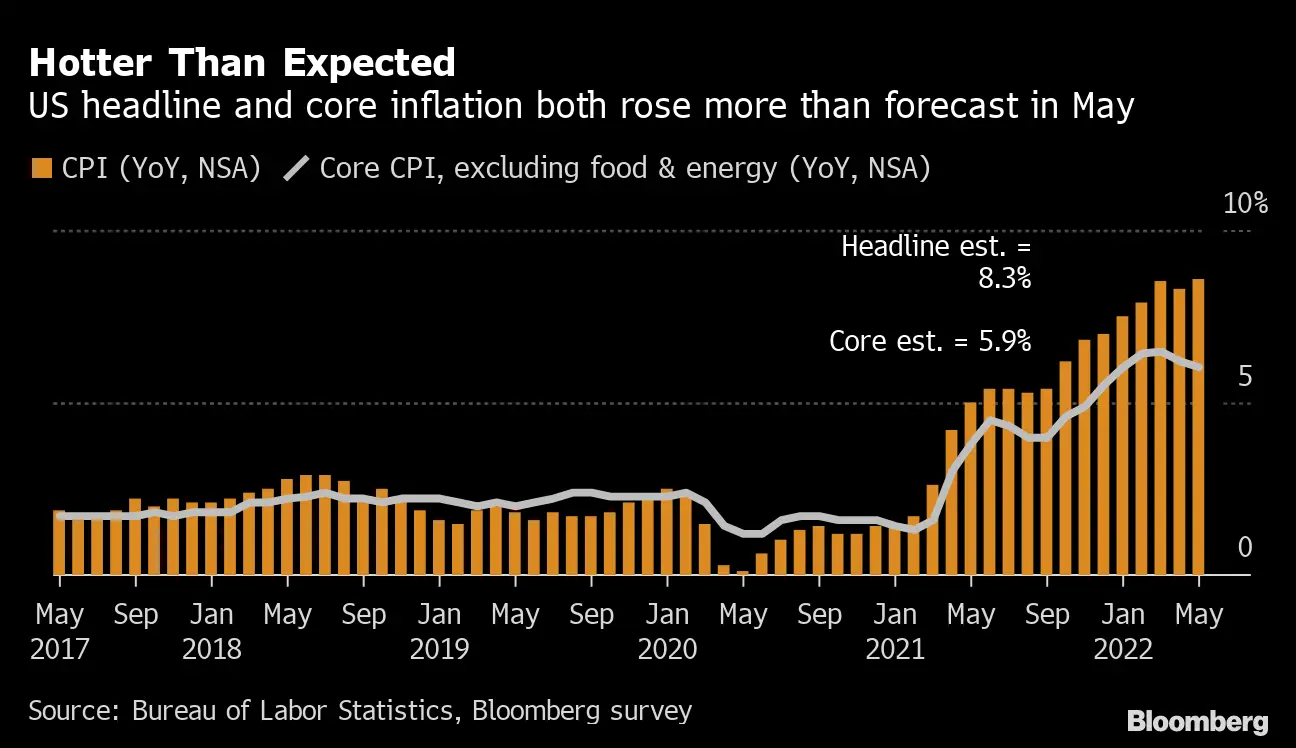

The latest data from the US Bureau of Labor Statistics showed that inflation had risen by 0.4% in the month of August, which was higher than the expected figure of 0.3%. This raises questions about the Federal Reserve’s plans to raise interest rates in the near future.

Inflation has been one of the key indicators that the Fed has been watching closely in recent months as they look to decide when to begin raising rates again. The Fed had previously stated that it would not raise rates until inflation reached its target level of 2%. However, with inflation now running above this level, it is possible that the Fed could start hiking rates sooner than expected.

Higher interest rates could lead to increased borrowing costs and lower profit margins for businesses. This could ultimately lead to job losses and slower economic growth. Higher interest rates could mean higher mortgage payments and credit card bills for consumers. This could strain household budgets and lead to less overall spending.

The Fed will need to weigh these potential impacts carefully before deciding on interest rates in the coming months. In the meantime, businesses and consumers will closely watch for any clues on where rates might head next.

What Would a Higher Inflation Rate Mean for Consumers?

A higher inflation rate would mean consumers would have to pay more for goods and services. This would also mean that interest rates on loans and credit cards would go up, making it more expensive to borrow money. In addition, a higher inflation rate would reduce the purchasing power of consumers’ incomes, which could lead to lower living standards. The latest US inflation data has raised questions about the upcoming interest rate hikes.

The September Consumer Price Index (CPI) showed that inflation had risen by 0.5% from the previous month, and was up 2.2% from a year earlier. This is the highest annual rate of inflation since March 2012. Several factors have contributed to this increase in inflation. Firstly, there has been an increase in the price of oil and other commodities.

Secondly, the strong US economy is driving up wages and prices. And finally, the recent tax cuts have also added to inflationary pressures.Some economists are now questioning whether the Fed will raise interest rates as planned in December. They argue that with inflation rising, it might be necessary to slow down the economy to keep prices under control.

What Would a Higher Inflation Rate Mean for the Economy in General?

Inflation is a key economic indicator used to measure the rate of price increases for goods and services. The latest inflation data from the US Bureau of Labor Statistics (BLS) showed that prices rose 0.3% in February, below expectations. This has led to questions about whether the Federal Reserve will raise interest rates at its upcoming meeting in March.

A higher inflation rate would mean that prices for goods and services would increase faster. This would cause people’s purchasing power to decrease, as their money would not go as far. In addition, it would lead to higher interest rates, as lenders would demand a higher return on their investment. Higher inflation could also lead to lower economic growth, as businesses (Cremation Services In Bangalore) may be reluctant to invest in an environment where prices constantly increase.

How to Keep Prices Low (SDLA)

The Federal Reserve’s target for inflation is 2%, which is the rate of inflation considered optimal for the economy. Inflation has been below 2% for most of the past decade, but it has started to rise in recent years. The latest data from the Bureau of Labor Statistics shows that inflation was 2.1% in 2017 and is expected to rise to 2.3% in 2018.