Personal finances are tight for many Americans these days. With rising inflation, a looming recession, and economic uncertainty ahead, getting your financial house in order is more important than ever. In today’s uncertain economy, mastering debt relief strategies is essential. Explore practical tips for financial stability amidst economic challenges. For those struggling with debt and credit issues, the current economic climate makes solving these problems especially challenging—but not impossible.

This article provides practical guidance on optimizing debt relief and credit repair even when money is tight. By following these best practices and leveraging the numerous available resources, individuals can make significant progress toward a healthier financial future.

Assessing Your Financial Situation

First, it’s essential to assess your financial situation honestly. Begin by making a comprehensive list of all your current debts, including credit cards, personal loans, medical bills, and any other outstanding obligations. Alongside each debt, note down the amount owed, interest rate, and minimum monthly payment.

After tallying up your total debts and summing the minimum payments, calculate how much disposable income you have left each month after covering these payments and your regular living expenses. This leftover amount is crucial, as it determines how much you can allocate towards paying down your debts faster.

Discovering that you have $100 or less in disposable income each month from your calculations suggests that paying off your debts will be challenging without making significant lifestyle adjustments. In this scenario, focus on contacting your creditors to negotiate lower interest rates, which can help reduce your monthly payments.

Allocate your disposable income towards paying off the debt with the highest interest rate first while making minimum payments on all other debts. However, if you find yourself with $250 or more in disposable income monthly, you have more flexibility to employ strategies like the debt avalanche or debt snowball method to accelerate your debt payoff.

Additionally, if you’re an elderly person, consider exploring free grocery card for seniors provided by some stores to help lower your monthly expenses. Many grocery shops offer free membership cards for shoppers over 60, which come with discounts. Taking advantage of senior discount programs can help stretch your limited income further.

For additional support, individuals may consider seeking advice from credit counseling services or exploring government debt relief programs. Additional options to consider include:

- Requesting goodwill deletion of negative items if you’ve paid debts in full

- Becoming an authorized user on someone else’s account with good or excellent credit

- Understanding the difference between fair vs good credit scores

- Consolidating multiple high-interest debts through balance transfer cards or personal loans

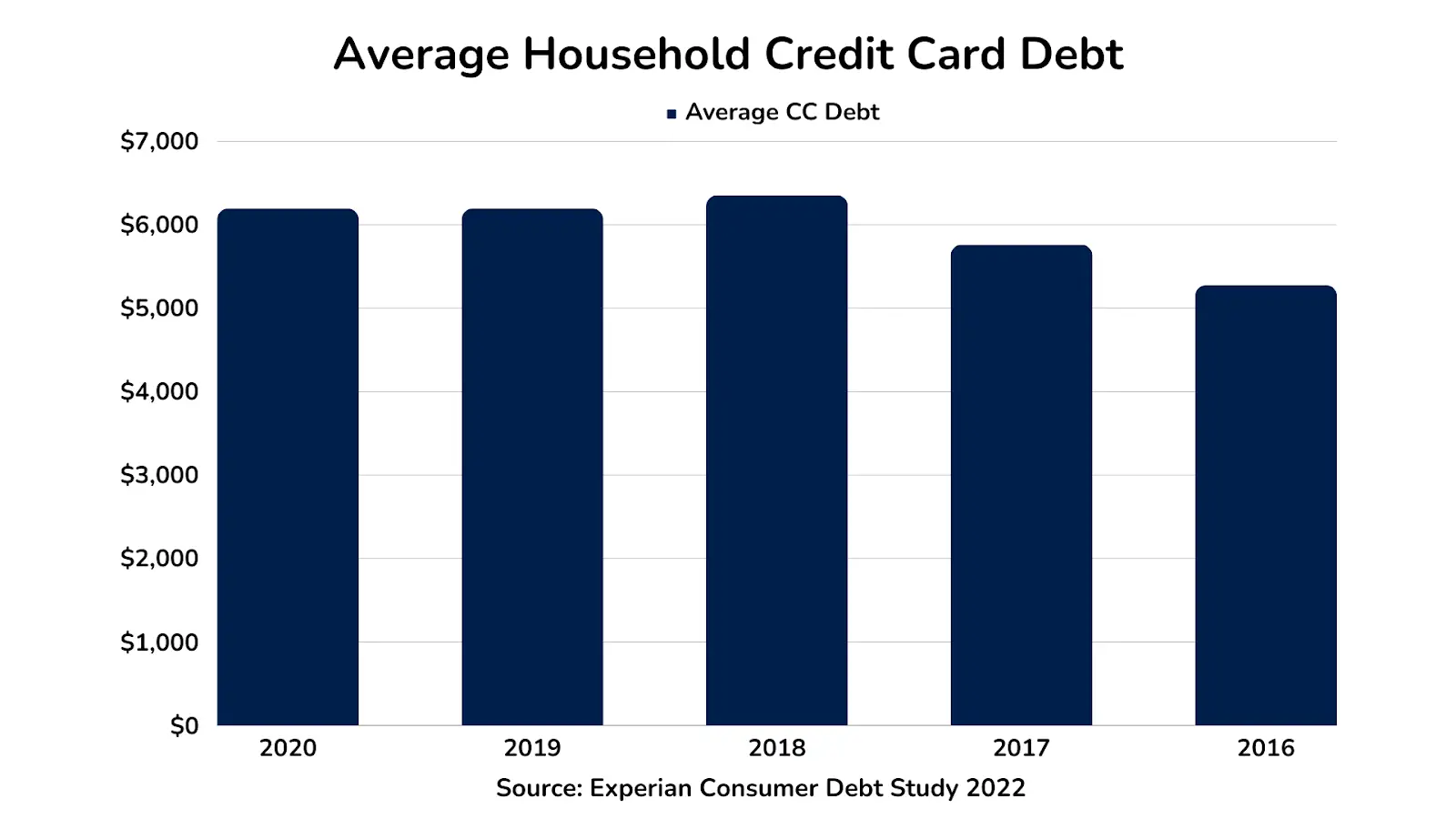

Credit card debt is one of the most common forms of consumer debt – as shown below, average credit card balances have steadily climbed over $5,000 per household in recent years:

This trend underscores the importance of effective debt management strategies and improving credit scores. Patience and discipline are essential in this process.

With some strategic planning, perseverance, and lifestyle adjustments, you can make steady progress toward debt relief and credit repair even when money is tight. The key is staying focused on the long game.

Strategies for Debt Relief

Getting out from under oppressive debt requires strategic approaches tailored to your unique financial circumstances. Here are some of the most effective debt relief tactics to consider:

Debt Consolidation

Debt consolidation streamlines multiple debts into one lower monthly payment, helping pay them off faster. You take out a consolidation loan and use funds to pay off existing debts, simplifying repayment. This works best for borrowers with good credit and steady income.

- Pros: One monthly bill, lower interest rate, pay off debt faster

- Cons: Temporarily lower credit score, loan fees, risk of racking up more debt

Consolidation loans are offered by credit unions, banks, peer-to-peer lenders, and credit counseling agencies. Secured debt consolidation uses an asset like your home as collateral, while unsecured loans are based on creditworthiness alone.

Conduct due diligence to get the best loan terms and ensure it will provide savings over current repayment costs. Debt consolidation success requires fiscal discipline – avoid the temptation to overspend just because you’ve lowered monthly bills.

Debt Settlement

Debt settlement involves negotiating directly with creditors or using a settlement firm. The goal is to agree on a lump-sum payment that’s less than the total owed. This can save you thousands of dollars but hurts your credit temporarily.

Settlements typically deliver savings of 25% to 50% off the original debt. However, creditors may balk if you propose overly low settlement offers. Be realistic based on your budget and the age of the debt.

Debt settlement works best for unsecured debts like credit cards, medical bills, and personal loans. Payday loans and auto financing are generally not ideal for settlement. Weigh the risks, as creditors may file lawsuits if you stop paying before settling.

Non-Profit Credit Counseling

Non-profit credit counseling agencies like NFCC offer debt management plans (DMPs) that consolidate unsecured debts into one payment with lower interest rates. Counselors provide budgeting guidance and negotiate waived fees with creditors.

DMPs work well for consumers struggling with high-interest credit card debt but are disciplined to stick to scheduled payments. Downsides include enrollment fees, potential credit score dings, and no guarantees creditors will accept the proposed terms. DMPs require you to commit to closing credit card accounts.

Bankruptcy

Filing for bankruptcy protects collections and can discharge certain debts. However, it damages your credit for years. Bankruptcy stays on credit reports for up to 10 years and can make it difficult to obtain loans and credit.

Consider bankruptcy only as a last resort if you have no way to repay debts and other options have failed. Meet with a bankruptcy attorney to fully understand the long-term consequences.

Debt Snowball and Avalanche Repayment Methods

The debt snowball and avalanche methods let you pay off debts faster by organizing them strategically.

The debt snowball method prioritizes paying off your smallest debt first before tackling larger ones. This “small wins” approach creates momentum and gives you tangible victories to stay motivated.

The debt avalanche method focuses on paying high-interest debts first. You’ll pay more in interest the longer high APR debts linger, so this method requires the most expensive debt balances first.

To start, make a list of all debts owed, ranked either by balance size (for snowball) or interest rate (for avalanche). Make minimum payments on all debts except the target one, putting as much disposable income towards the target as possible until paid off. Then proceed to the next debt on your ranked list.

Both methods work – choose the one aligned with your personality and needs to create debt repayment focus and motivation. Automate payments towards target debts to implement your chosen repayment plan efficiently.

How Debt Relief Affects Your Credit Score

The strategies discussed for debt relief can provide financial breathing room by reducing payments, interest rates, and balances owed. However, many debt relief methods also impact your credit score. Understanding these effects lets you make informed choices.

Debt consolidation loans can lower your credit utilization ratio, which improves your score. But closing old credit card accounts lowers your total available credit and number of open accounts, negatively affecting your score.

Debt management plans through credit counseling do not require closing accounts. They can lower interest rates which helps credit. However, enrollment can show up on your credit report and lower your score until debts are paid off.

Debt settlement almost always causes a major hit to your credit score. Accounts get closed, you stop making payments, and settled accounts are usually noted on your credit report. The damage can linger for up to 7 years.

Bankruptcy devastates credit scores the most. A Chapter 7 or Chapter 13 bankruptcy remains on your credit history for 10 years. Scores can drop by over 200 points.

Once debts are resolved through relief programs, responsibly using credit and maintaining on-time payments will help rebuild your score over time. Pay down balances, dispute errors, and limit new credit applications. With diligence, your credit can be recovered.

Navigating Credit Repair

In tandem with debt relief efforts, take actions to repair and build your credit. Allowing bad credit to linger will only make debt problems worse through higher interest rates. Here are proven ways to improve your credit even when money is tight:

- Dispute errors on your credit reports. Errors like incorrect late payments or loan terms drag down your score. Initiate disputes with credit bureaus to fix mistakes.

- Bring past-due accounts current. Contact creditors for options to repay overdue debts in affordable monthly payments that fit your budget.

- Keep credit card balances low. Reduce balances below 30% of the card limit, with lower utilization ideals. Consider balance transfer cards.

- Become an authorized user. Ask a family member with good credit to add you as an authorized user on a credit card account to benefit from their strong payment history.

- Limit new credit applications. Too many new accounts can signal credit risk, so only apply for what you truly need.

- Consider credit-builder loans. These loans with monthly payments reported to credit bureaus can help establish a positive payment history.

With diligence and patience, these actions can significantly improve your credit over time even in a strained economy.

Government and Nonprofit Resources

Don’t go it alone. Federal, state, and nonprofit programs offer various forms of assistance with bill payments, housing costs, medical bills, and other debt-related expenses. Explore these options to ease the debt burden:

- Federal student loan repayment programs like income-driven repayment and loan forgiveness

- Mortgage and foreclosure assistance such as forbearance or mortgage modification from the lender

- Federal, state, and local government assistance programs for help with utilities, medical costs, food, and temporary cash assistance

- Bankruptcy counseling and legal aid from organizations like Legal Aid and pro bono legal groups

- Free financial counseling and debt management from nonprofits like NFCC and Money Management International

- Unemployment support including extended benefits and retraining programs

Tap into every available resource you qualify for. Even modest relief on monthly bills can make paying off debt more manageable.

Coping With Debt-Related Stress

Debt takes both a financial and emotional toll. Don’t hesitate to seek support if debt negatively impacts your mental health:

- Connect with others. Join a support group to gain encouragement and insights from those overcoming similar challenges.

- Seek counseling. Financial counselors and therapists can provide strategies to manage stress.

- Practice self-care. Make time for adequate sleep, exercise, nutritious food, and activities that bring you joy.

- Avoid destructive coping mechanisms. Alcohol, gambling, and other escapes only worsen problems.

- Celebrate wins. Recognize each debt paid off and credit score increase to stay motivated.

- Look to the future. Remind yourself the situation is temporary and focus on the financial freedom ahead.

You have the power to take control of your finances, even in tough times. By consistently applying the debt relief and credit repair strategies explored above – and getting support when challenges arise – you can achieve financial stability. With strategic money management and patience, a brighter financial outlook is within reach.

Key Takeaways

- Carefully evaluate income, expenses, debts, and credit to understand your financial starting point and opportunities

- Employ proven debt relief strategies like consolidation loans, settlement negotiation, and repayment plans

- Build credit with techniques like dispute resolutions, lower balances, and becoming an authorized user

- Seek guidance and resources from non-profit credit counselors and government aid programs

- Monitor your credit reports and scores to track positive progress over time

- Remain disciplined, patient, and consistent with debt relief efforts for the best results

- Celebrate small wins, stay motivated, and don’t be afraid to get help along the way

FAQs

- How long will it take to rebuild my credit while paying off debts?

Rebuilding your credit while paying off debts takes time and consistency. Usually, people start seeing improvements in their credit scores within 6 to 12 months if they manage their credit responsibly.

But if you have serious debts or collections, it might take several years for the negative information to clear from your credit report. The important thing is to be patient and show that you can handle credit responsibly over time.

- What are the risks of working with a debt settlement company?

Working with a debt settlement company has its risks. These companies often charge high fees, typically around 15% to 25% of the total debt you owe. Settling debts for less than what you owe can also really hurt your credit score. Sometimes these companies might even pressure you to stop paying your creditors, which can lead to late fees, higher interest rates, and aggressive collections.

However, if you’re struggling to pay off a lot of credit card debt, a reputable debt settlement firm can help negotiate lower settlements and avoid bankruptcy. Just make sure to thoroughly research any company before you decide to work with them.

- Can I qualify for government assistance with medical bills?

If you’re struggling with large medical debts, government, and nonprofit programs may be able to help, including Medicaid, Medicare Savings Programs, and assistance from hospitals or community health clinics. Local nonprofits may provide medical bill counseling and referrals to financial aid programs. Those who itemize deductions can deduct qualified medical expenses

- What is the best way to start repairing my credit score?

Start by pulling your credit reports and disputing any errors. Also, commit to paying all bills on time going forward. Pay down balances below 30% of the credit limit and keep your credit utilization low.

- Is debt consolidation or debt settlement better for credit card debt?

Debt consolidation is usually better for managing credit card debt since it allows you to pay off the balances faster with a lower interest rate. Debt settlement typically has a more negative impact on your credit.

- How does debt consolidation affect your credit score?

It may cause a small temporary dip from closing accounts but then helps by lowering your credit utilization. Overall the impact is usually minor, and your score will improve over time as you pay down the consolidated balance.

- Can I negotiate debt settlements myself or do I need to hire a company?

You can negotiate debt settlements yourself directly with creditors, but professional firms have the experience to potentially negotiate better terms. If hiring a company, research its reputation thoroughly first.

- Are non-profit credit counselors better than other options?

Reputable non-profits like NFCC are staffed with certified counselors and offer services on a sliding scale. They can provide unbiased guidance but may not always get optimal debt relief terms compared to other options.

- How do I choose between the debt snowball and avalanche payoff methods?

The debt snowball is best if you need quick wins to stay motivated. The debt avalanche method is most efficient if you strictly want to pay the least interest. Assess your personality to select the right approach.

- Will debt settlement or bankruptcy show up on my credit report?

Yes, both will damage your credit score and be visible on your report. A debt settlement will show settled accounts for up to 7 years. A bankruptcy will appear for 10 years.

- How much does credit counseling cost?

Reputable agencies offer services on a sliding scale based on your ability to pay. Fees are typically $25 to $50 per month. Initial consultations are often free.

- What types of debt can be discharged in bankruptcy?

Common dischargeable debts include credit cards, medical bills, personal loans, and utility bills. Student loans and back taxes are typically not dischargeable. Meet with a bankruptcy lawyer to understand your options.

- Should I close all my credit cards if I’m in debt?

Not necessarily. Having open and active credit accounts helps your credit score and available credit. Consider closing newer cards you don’t need, but leave your oldest accounts open.

- How long do debt settlements stay on your credit report?

Debt settlements typically remain for around 7 years from the date the account is settled or closed. The debt will show as settled rather than delinquent during this period.

- Is credit counseling a good option for someone with a lot of credit card debt?

Yes, enrolling in a non-profit credit counseling agency’s debt management plan can reduce interest rates and provide an organized way to pay down credit card balances through one consolidated payment each month.

Final Thoughts About Debt Relief Strategies

Mastering debt relief strategies is crucial for achieving financial stability in today’s economy. Start implementing these tips today for a brighter financial future.