In today’s digital era, running a cash-only business has its own benefits. For example, you don’t have to pay credit card fees or deal with chargeback fraud. You receive money for your services and products immediately.

However, just because you’re accepting only cash does not mean you’re safe from scams and fraud. People can slip fake bills in the final payment, and employees can take away some money from the bill checker machine. You won’t even know! So, to run a safe cash-only business, you must follow some important tips. We’ll discuss them in detail below. Let’s get started!

Remind Your Customers

People are used to making payments through cards and mobile apps. It’s easy, safe, and quick for them. So, naturally, they will expect to use the same modes at your shop. You must clarify that you are a cash-only business. This can be done by putting up physical signs and notice boards around/outside the store. If you receive new customers every day (e.g., food trucks), you must inform them before they start selecting products.

Another way to make this information well-known is to mention it in your social media posts. It doesn’t matter whether you market through Instagram, Facebook, a website, or any other channel. State clearly in your posts that you only accept cash payments.

Train Your Employees

All cash-only businesses must train their employees on how to handle cash. It’s simply because you can never fully trust the customers. Your customer may:

● Use old, worn-out, or fake money

● Claim to have paid a larger amount

● Blame the employee for theft

Your employee must stay focused and attentive when handling money. There must be no multitasking or divided attention. Also, the employee should be equipped with bill checker machines and pens to identify fake money.

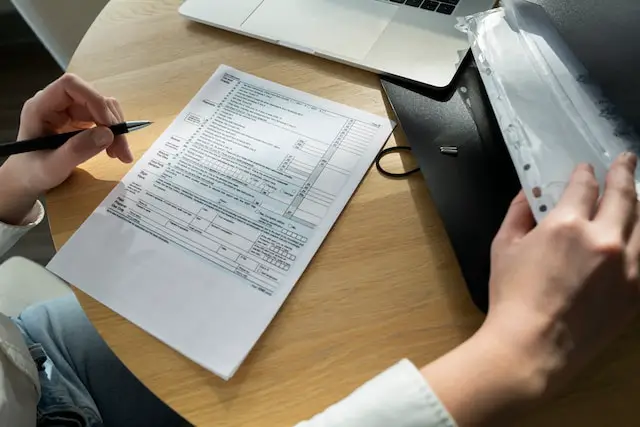

Maintain Accurate Records

Record-keeping is crucial to prevent theft and money loss. When you are not taking digital payments, you must record every transaction manually. You can use a register, spreadsheet, etc. Just make sure you have written everything correctly. This will help you track down any employee theft or loss. If you can’t do this task yourself, outsource it to a professional.

Take Care of the Policies

The Internal Revenue Service (IRS) department has set an obligation on cash-only businesses that you should be aware of. If your customer makes a big purchase (over $10,000) and pays the amount in one or two transactions, you must fill the Form 8300.

This form requires details about your client, purchase, and your business. It should be filled by the 15th day after you have received the payment. You can print out the form from the IRS website and send it through mail or just fill it out electronically. Please note that your customer should also receive a written statement. If you fail to meet this requirement, IRS may take legal action against you and your business.

FAQ on Running A Cash Only Business

What are the benefits of running a cash-only business?

Cash-only businesses can save on credit card fees, avoid chargeback fraud, and receive immediate payments for their services and products.

What are some ways to prevent fraud in a cash-only business?

To prevent fraud, it’s important to train employees on cash handling, use bill checker machines, and maintain accurate records of all transactions.

What are the IRS regulations for a cash-only business?

For cash transactions over $10,000, the IRS requires businesses to fill out the Form 8300, which collects details about the client, purchase, and business.

Final Thoughts on Running A Cash Only Business

As we’ve shown, running a cash-only business is a fine art that involves vigilant fraud prevention, diligent record-keeping, and adept navigation of IRS regulations. Although it may seem counter-intuitive in our digital age, it could be the perfect choice for your business venture.